Automated Access Reviews Help Regional Bank Avoid Penalties

Industry Type

Financial Services, Banking

Use Cases

Access Reviews

Frameworks

Customer Specific

Impact

Challenge: Conducting risk assessments for more than 1000 disparate branches

Solution: RegScale’s automated compliance workflows and risk assessments

Results: Rapid automation of assessments for compliance, avoiding millions in fines

Outcomes with RegScale

- Supercharged existing GRC/IRM for centralized data across systems

- Automated and expedited user access reviews to remediate MRAs

- Enabled real-time visibility and metrics through reports and dashboards

Summary

In the face of federal matters requiring attention (MRAs), a regional commercial bank partnered with RegScale to automate user access reviews, fix issues, and modernize and expedite supporting compliance processes.

Challenge: conducting risk assessments for more than 1000 disparate branches

This regional commercial bank was pressed into conducting risk assessments for more than 1,000 assets using disconnected systems of record and manual processes. These assessments would drive additional compliance and risk activities, including numerous user access reviews.

To make matters worse, the bank was facing federal matters requiring attention (MRAs). Complicating this compliance was the fact that assets, risks, and controls data were housed across numerous disparate systems. Furthermore, there was no mechanism for real-time visibility, reporting, or metrics. Instead, numerous manual processes, including “stare and compare” testing of user access hampered reporting and heightened exposure to errors.

Solution: RegScale’s automated compliance workflows and risk assessments

The institution turned to RegScale to implement automated risk and compliance assessments and workflows quickly. They started by connecting previously disparate systems, including configuration management database (CMDB), identity and access management (IAM), and integrated risk management (IRM). The bank established a centralized system of record with real-time reporting on compliance gaps, self-updating audit paperwork, and visibility through reporting and dashboards.

Result: rapid automation of assessments for compliance, avoiding millions in fines

Through rapid implementation and automation, now the bank can accurately report on improved compliance with required user access reviews. This has enabled the bank to avoid millions of dollars in potential fines.

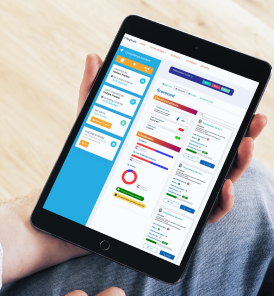

Through seamless integration with the bank’s disparate legacy systems, RegScale supercharged their existing cumbersome governance, risk, and compliance (GRC), IRM, and other tools, centralizing data across systems. RegScale’s SaaS solution provides the bank with self-updating audit paperwork and automated audit reports. Bank executives now also enjoy real-time visibility and metrics through reports and dashboards that even prove automated alerts when issues with controls arise.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc urna tellus, venenatis sed massa ac, fermentum porttitor tortor. Donec sit amet velit pellentesque sapien consectetur efficitur. Nulla in tincidunt erat, pulvinar eleifend metus. Sed nec massa tempus risus rhoncus maximus. Donec et placerat ex, ut faucibus eros. Sed rutrum libero vulputate, tincidunt dui eu, condimentum quam. In a volutpat nulla. Morbi aliquet accumsan augue, quis laoreet libero euismod quis. Vestibulum vitae quam luctus, rutrum lacus eu, lobortis odio. Mauris in neque convallis ligula rutrum blandit a in massa.

Read more success stories

See what RegScale can streamline for you

Book a demo now for a quick walkthrough of how our continuous controls monitoring can solve your compliance, risk, and cybersecurity challenges.