Private Equity Firm Automates Security & Risk Management

Industry Type

Financial Services

Use Cases

Simplified Risk Management

Frameworks

Customer Specific

Impact

Challenge: Elevating cybersecurity visibility in private equity investments

Solution: Implementing RegScale for streamlined cybersecurity oversight

Results: Successfully established a robust framework that enabled them to monitor GRC processes, threat intelligence, and threat response across their investment portfolio

Outcomes with RegScale

- Simplify and automate security and risk oversight of investment portfolio companies

- Proactively monitoring GRC health, threat management, and performance metrics

- Increasing investment values by improving cybersecurity posture

Summary

A private equity firm chose RegScale to improve the cybersecurity posture of its portfolio companies through automation and real-time oversight of security and risk.

Challenge: elevating cybersecurity visibility in private equity investments

In the fast-paced world of private equity, a leading firm found itself grappling with a significant challenge: limited visibility into cybersecurity and risk posture of its diverse portfolio companies. This firm, renowned for providing expert oversight and advisory services, was in dire need of a solution that would enable them to monitor activities, status, and trends in security, risk, and compliance across their investments with precision and ease. The lack of comprehensive compliance information and reliance on manual processes for governance—such as confirming policy enforcement or building programs—hampered their ability to safeguard their investments effectively.

Solution: implementing RegScale for streamlined cybersecurity oversight

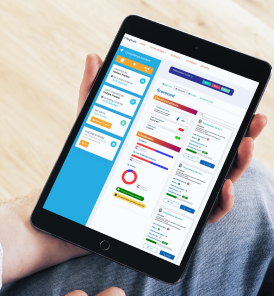

In their quest for a solution that could meet their stringent requirements, the firm chose RegScale for its promise of rapid and effortless implementation. RegScale’s continuous controls monitoring (CCM) platform included governance, risk management, and compliance (GRC) alongside threat categories, all delivered with the convenience of extreme automation and multi-tenancy. This feature was particularly attractive as it allowed for the segregation of data among the investment companies, simplifying processes within a single, cloud-native platform. Moreover, RegScale’s promise of real-time visibility into security, risk, and compliance status and trends through intuitive dashboards and reports was exactly what the firm needed to overcome their previous limitations.

Result:

Within a mere few weeks, they had successfully established a robust framework that enabled them to monitor GRC processes, threat intelligence, and threat response across their investment portfolio. The transformation was profound including oversight and monitoring of security, risk, and compliance activities. Once a daunting challenge, these were now seamlessly managed through questionnaires and real-time dashboards. The firm’s journey from grappling with limited visibility and manual processes to achieving a state-of-the-art cybersecurity oversight capability stands as a testament to the power of innovative technology solutions in empowering private equity firms to protect their investments and foster a secure, compliant, and resilient operational environment.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc urna tellus, venenatis sed massa ac, fermentum porttitor tortor. Donec sit amet velit pellentesque sapien consectetur efficitur. Nulla in tincidunt erat, pulvinar eleifend metus. Sed nec massa tempus risus rhoncus maximus. Donec et placerat ex, ut faucibus eros. Sed rutrum libero vulputate, tincidunt dui eu, condimentum quam. In a volutpat nulla. Morbi aliquet accumsan augue, quis laoreet libero euismod quis. Vestibulum vitae quam luctus, rutrum lacus eu, lobortis odio. Mauris in neque convallis ligula rutrum blandit a in massa.

Read more success stories

See what RegScale can streamline for you

Book a demo now for a quick walkthrough of how our continuous controls monitoring can solve your compliance, risk, and cybersecurity challenges.