Get Proactive with a Continuous Risk Management Approach

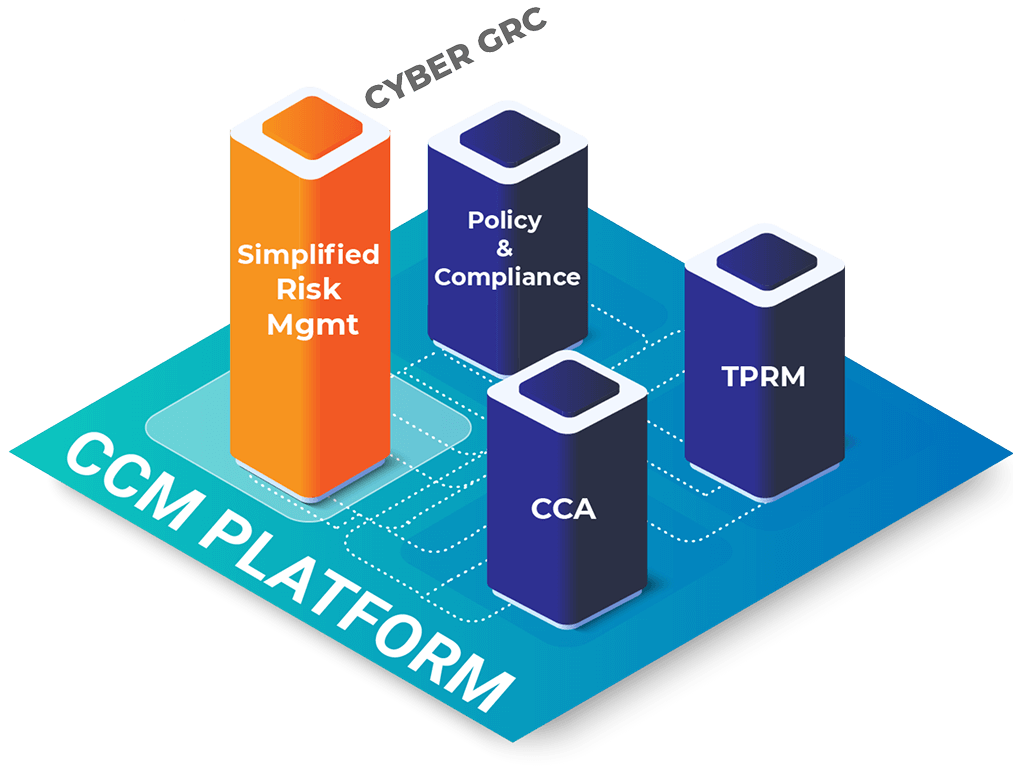

Revolutionize your risk management with RegScale’s Continuous Controls Monitoring platform and replace manual processes with a proactive, automated approach. Seamlessly integrate threat models and asset risks and automate compliance reporting to fortify your security posture.

According to Gartner®,

“By 2026, 60% of executive leaders will treat risk and security as a critical investment to achieve enterprise revenue growth.”*

Trusted by the most secure and compliant organizations on the planet

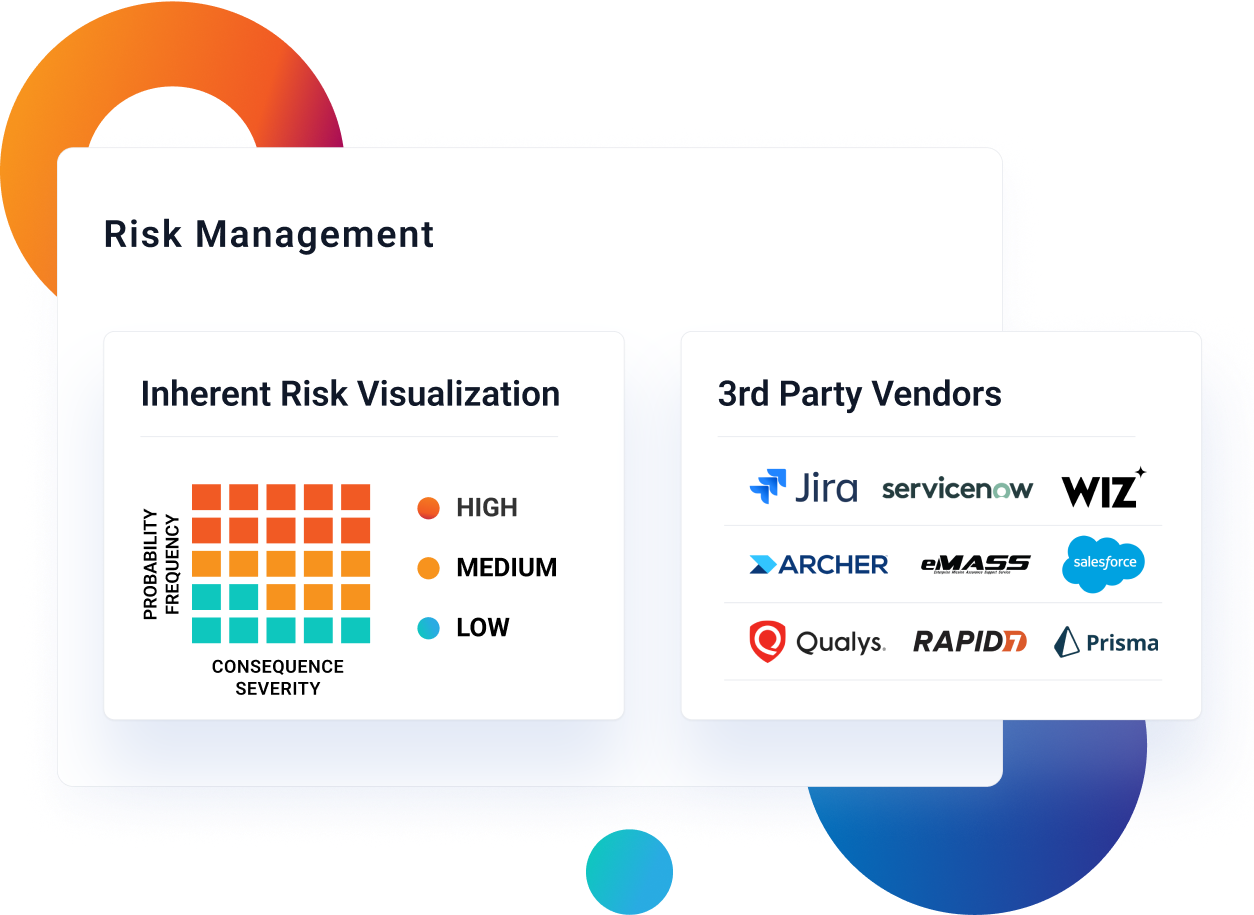

Simplify Your Risk Management

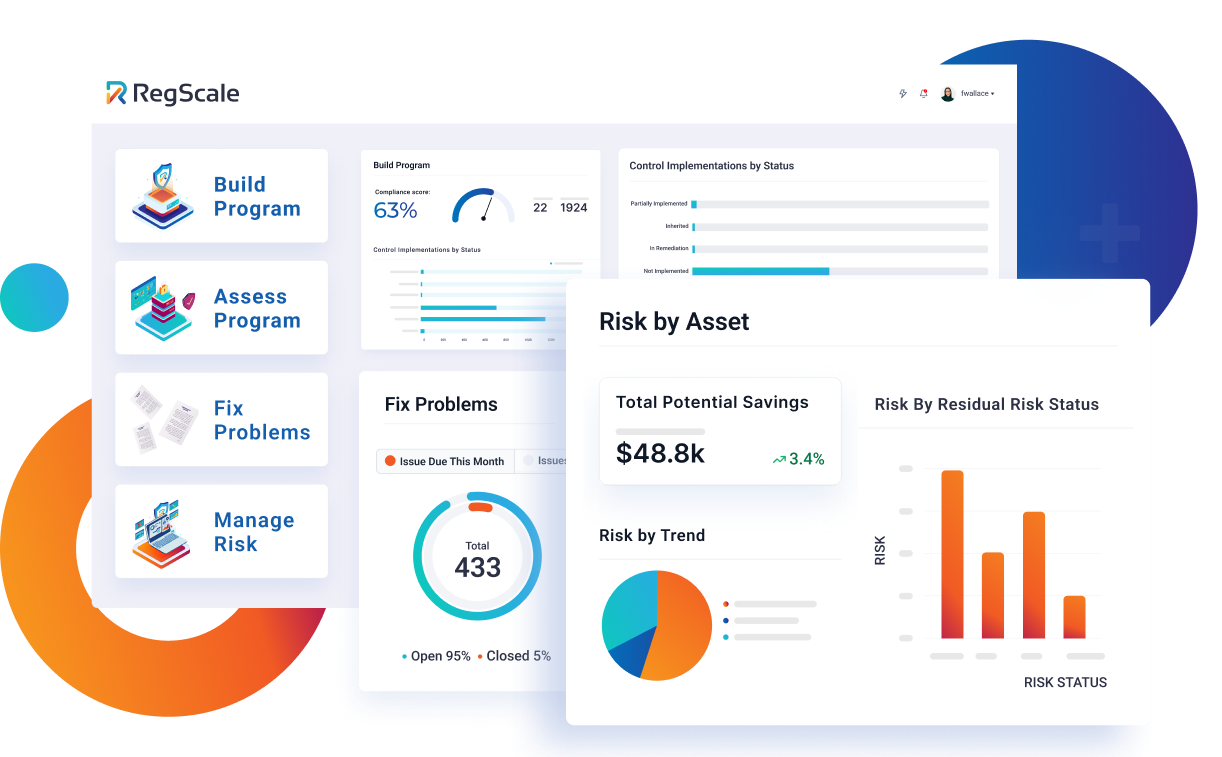

Risk management is often fragmented, relying on manual risk registers and backward-facing analyses. With RegScale’s Continuous Controls Monitoring (CCM) platform, organizations can embrace dynamic threat models, proactive mitigation, and real-time alerts. Consolidate your risk assessments from compliance to TPRM, business impact assessment, financial risk, asset risk, and enterprise risk — enabling swift, informed decisions.

Streamlined Asset Risk Management

Cut through the noise of endless patch cycles. Our platform focuses on prioritizing the assets that matter most to your business, reducing vulnerabilities and enhancing your security posture.

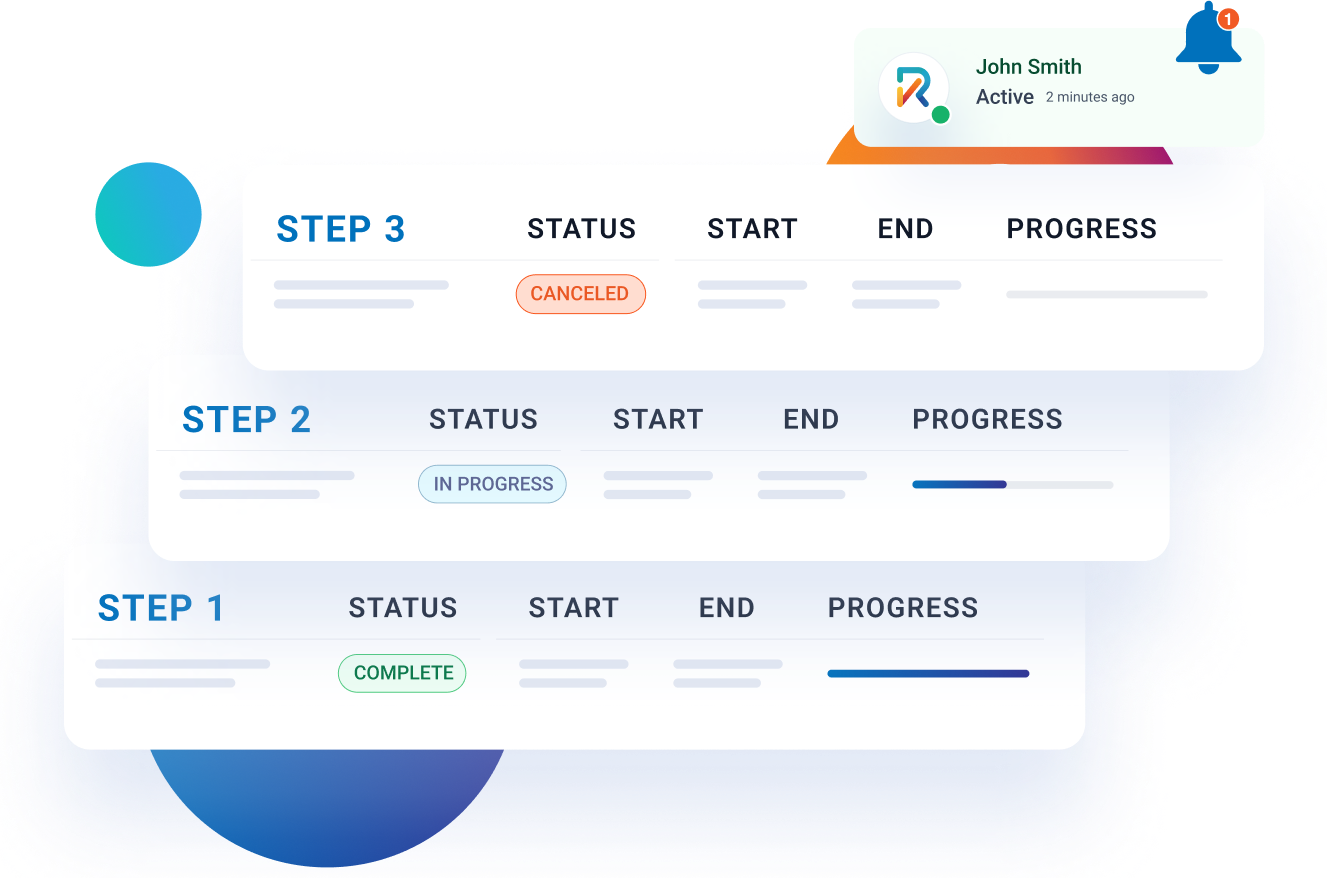

Unified Reporting and Collaboration

Break free from siloed processes, outdated data, and after-the-fact risk management. Use the RegScale platform to get real-time alerts, collaborate seamlessly across tools, clouds, and departments, and roll up risk data for comprehensive insights across business units, processes, and systems.

Enhanced Governance and Compliance

Strengthen your governance and compliance processes with our simplified risk management solution. From audit risk and issues tracking to third-party risk management, business impact assessment, financial risk, asset risk, and enterprise risk, RegScale ensures robust risk management that’s aligned with industry standards and tailored to your business needs.

See what RegScale can streamline for you

Book a demo now for a quick walkthrough of how our Continuous Controls Monitoring platform can solve your security, risk, and compliance challenges.

Ready to fast track your compliance? Let us show you how it’s done

Reading can only get you so far. That’s why we’d like to give you a quick live walkthrough of RegScale to show you exactly what we can do for your organization.

More ways to stay up to date

Get insights delivered to your inbox

Receive platform tips, release updates, news and more

*Gartner, Use Protection Levels to Create Defensible Risk Appetite Statements, Paul Proctor, Michael Kranawetter, et al., 24 June 2024. GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.