Transform Your Regulatory Exam Management: 60% Faster Response Times, Zero Weekend Emergencies

Trusted by the most secure and compliant organizations on the planet

The Regulatory Response Challenge (And Why Manual Processes Are Failing)

Traditional regulatory examination management leaves compliance teams scrambling through spreadsheets, emails, manual paperwork, and scattered systems to meet tight deadlines.

The result? Weekend work becomes standard, responses lack consistency, and compliance gaps grow.

We’ve Automated What Others Still Do Manually

RegScale transforms regulatory response from a constant struggle into a series of efficient automated workflows.

- Our platform digitizes incoming regulatory requests, automatically assigns them to appropriate team members, and collects evidence through API integrations with your existing systems.

- Cross-framework control mapping ensures consistency and reuse of evidence and documentation across multiple regulatory requirements, eliminating duplicate and potentially inconsistent work.

- OSCAL-native architecture enables compliance as code, allowing organizations to shift left in their DevSecOps processes and embed regulatory requirements directly into their workflows.

- Intelligent automation turns exam chaos into streamlined operations, cutting audit prep and response time and effort by 60% and eliminating weekend fire drills.

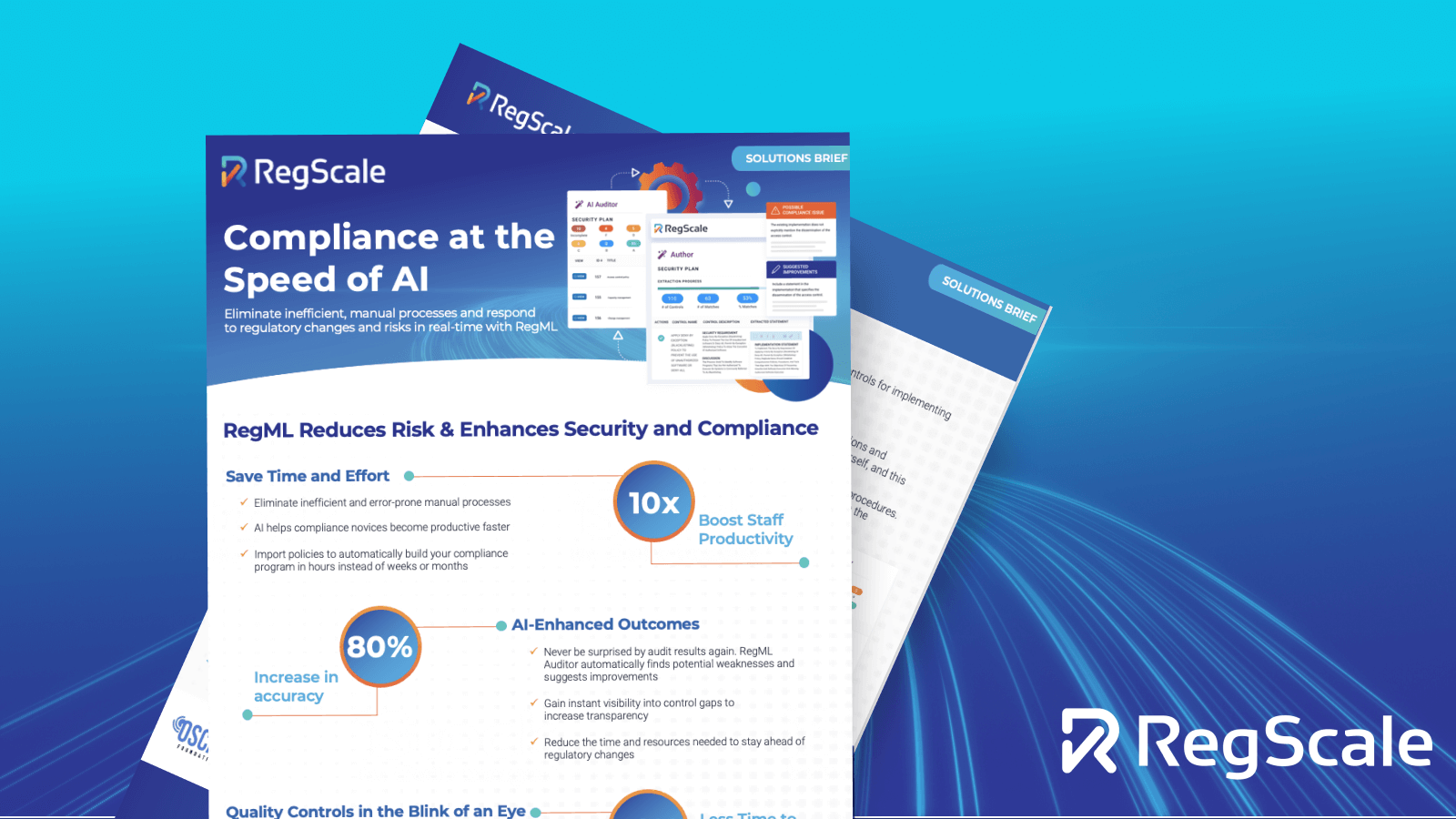

Advanced AI for Regulatory Response

RegScale’s RegML suite brings artificial intelligence directly into the regulatory response process.

- RegML Author automatically drafts initial responses to regulatory requests.

- RegML Auditor proactively analyzes your work for completeness and quality before submission.

- RegML Responder pre-populates responses to incoming questionnaires by leveraging your existing documentation and evidence base.

These AI capabilities don’t replace human judgment; they enhance it by handling tedious routine tasks and allowing your team to focus on strategic work instead.

See what RegScale can streamline for you

Book a demo now for a quick walkthrough of how our continuous controls monitoring can solve your cybersecurity, risk, and compliance challenges.

The Game-Changing CRI Collaboration

RegScale’s collaboration with the Cyber Risk Insitute transforms the powerful CRI Profile v2.1 into operational reality in a single pane of glass. Here’s how it works:

- The Cyber Risk Institute Profile v2.1 condenses over 2,500 global regulatory and supervisory requirements into 318 diagnostic statements.

- With pre-built control mappings to 25+ source documents (including the CIS Critical Security Controls, NIST 800-53 Rev. 5, and DORA), CRI allows organizations to skip the guesswork and leverage existing frameworks.

- RegScale’s platform handles the operational heavy lifting, automating evidence collection, control assessment, responses to first day letters, and more.

- RegScale’s robust dashboard and reporting capabilities allow for near real-time monitoring and comprehensive visibility into your cyber risk posture.

Beyond the FFIEC CAT

With the August 2025 sunset of the Federal Financial Institutions Examination Council Cybersecurity Assessment Tool (FFIEC CAT), financial institutions are moving to modernize their approach to cyber risk management. We’ve got suggestions.

Leading the Future of Financial Services Compliance

Banks and financial institutions need platforms that can adapt to the changing requirements and realities of regulatory exam management. RegScale is purpose-built to automate routine processes, centralize evidence management, and provide intelligent response capabilities — helping financial services shift from reactive compliance to proactive, efficient regulatory exam management.

Ready to transform your regulatory response process? Book a call with us to see how leading financial institutions are achieving 60% faster response times while eliminating compliance emergencies.

More ways to stay up to date

Get insights delivered to your inbox

Receive platform tips, release updates, news and more